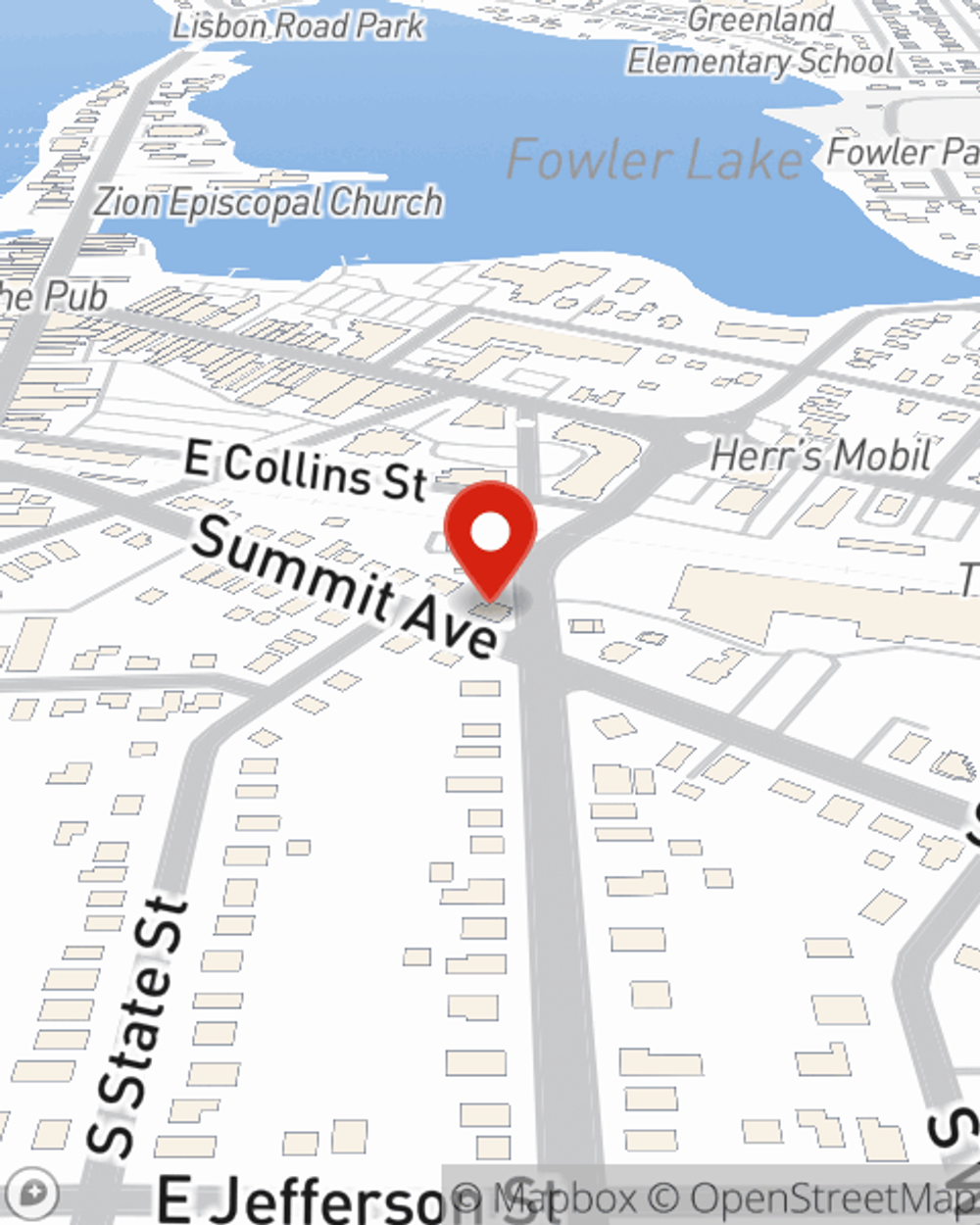

Business Insurance in and around Oconomowoc

Looking for small business insurance coverage?

No funny business here

State Farm Understands Small Businesses.

Sometimes the unpredictable is unavoidable. It's always better to be prepared for the unfortunate accident, like a staff member getting hurt on your business's property.

Looking for small business insurance coverage?

No funny business here

Surprisingly Great Insurance

Planning is essential for every business. Since even your brightest plans can't predict product availability or consumer demand. In business, you can be certain of one thing: nothing is certain. That’s why it makes good sense to plan for protection with a State Farm small business policy. Business insurance is necessary for many reasons. It protects your future with coverage like worker's compensation for your employees and business continuity plans. Terrific coverage like this is why Oconomowoc business owners choose State Farm insurance. State Farm agent Will Edwards can help design a policy for the level of coverage you have in mind. If troubles find you, Will Edwards can be there to help you file your claim and help your business life go right again.

Intrigued enough to investigate the specific options that may be right for you and your small business? Simply reach out to State Farm agent Will Edwards today!

Simple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

Will Edwards

State Farm® Insurance AgentSimple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.